06-06-2018

Road fuel: AdC insists on access to logistics infrastructures and cautions on fiscal policy costs

Press Release 05/2018

Road fuel: AdC insists on access to logistics infrastructures and cautions on fiscal policy costs

The Portuguese Competition Authority - Autoridade da Concorrência (AdC) has concluded the road fuel price analysis requested by the Portuguese Government. The AdC insists in the promotion of access to logistics infrastructures for liquid road fuels and cautions on fiscal policy costs.

Alongside price analysis, the AdC has also developed a follow-up analysis of its previous recommendations. The AdC has concluded that almost half of the nearly three dozen measures recommended in 2009 and 2012 to promote competition in the sector have not been implemented or have only been partially implemented.

Hence, the AdC presents a "4th package" of Recommendations to the Government aimed at promoting competition and providing more competitive offers for consumers in the road fuel sector. These include, for example, the completion of the pipeline connection between the Galp refinery and the port of Sines, which remains incomplete and limits the third-party use of the storage facility of the CLC - Companhia Logística de Combustíveis and access to competitive imports.

The AdC is particularly concerned with the high degree of concentration and the existence of barriers to entry in the refining and storage activities, as these strongly influence the remaining activities, in particular retailing.

Galp still holds most of the import/refinery depots capacity in Portugal, with its refineries providing almost half of the fuel storage capacity in mainland Portugal.

The AdC urges the promotion of competition for the market in the sub-concession for service stations on motorways. In spite of a window of opportunity in 2015, with the end of the sub-concession contracts of some motorway service stations, not all were subject to new award procedures, at least until June 2017, according to information submitted to the AdC.

Those cases, for which there was in fact a new procedure, did not verify all the measures recommended by the AdC, and the procedure’s result mostly maintained the previous sub-concessionary companies.

In the analysis here presented, the AdC noted that the increase in gross margins in 2015 occurs alongside a sharp fall in international reference crude oil prices, allowing for an increase in margins in the short-run.

There was, however, a relative stability of the absolute gross margins in the sector and greater volatility of the mark-up (percentage margin) as a result of the variability of prices (in the denominator).

The AdC also noted an increase in the relative consumption of premium diesel in detriment of simple diesel. It cannot be ruled out that this switch has contributed to the increase in margins.

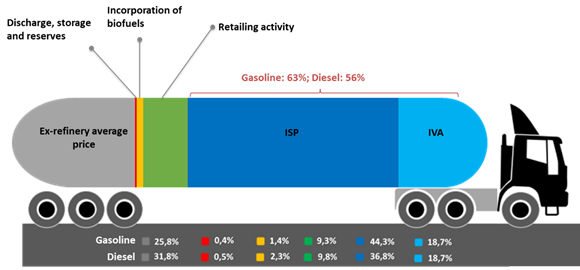

In relation to the fiscal policy costs, the AdC notes that this is the component with the highest relative weight in the road fuel retail prices, having increased by 56% in diesel and 26% in gasoline since 2004.

Accounting for taxes and biofuels, the road fuel retail price competitiveness in Portugal decreases significantly, in particular when compared to Spain, as the tax burden and biofuel incorporation rates are heavier in Portugal. In fact, average prices of road fuels in Portugal were consistently more competitive than the average prices practiced in Spain from 2013 on 95-octane gasoline and from 2014 on diesel. However, this trend was interrupted in the third quarter of 2015.

Relative weight of each component in the road fuel retail prices (in %), 22/02/2018

Note 1: “Retailing activity” includes secondary logistics and commercial margins. “Ex-refinery average price” includes international quotations and freight.

Note 2: The figure illustrates the relative weight of each component in the retail prices of gasoline for road use (in %) at 22/02/2018.

Note 3: ISP –Special tax on oil products; IVA – Value added tax.

Source: Data ENMC and DGEG – AdC.

June 7, 2018